Photo Credits: Angela Morant/ECB

There is one issue, however, on which I can be decisive today: we must explain much better to the general public what we are doing and why, and we must talk to people that we do not normally reach. This imperative has to cascade through all the elements of our review: our inflation aim, our inflation measure, our tools and their effectiveness, and how we take into account new challenges that people care about, like climate change or inequality. – Lagarde (2020)

As Christine Lagarde, President of the European Central Bank, admits, central banks have much to improve in terms of communication with the general public. It has been argued that this topic received too little attention in the academic literature in the past (Haldane and McMahon (2018)). However, there seems to be a changing trend, both from the banks’ side but also from the academic side (Hansen, Lin, and Mano (2023)). The academic analysis does, however, rely on anecdotal evidence, citing only a few speeches. In this piece, I want to briefly discuss central bank communication from a philosophical angle, and empirically evaluate this communication.

What should central banks talk about?

Based on widely cited accounts on theory of the state, such as Habermas (1994) and Cohen (1997), I think it should be uncontroversial to claim that democratic governing bodies, including the central banks need to communicate their policy decisions to have democratic legitimacy. I also think that this communication needs to include reasons for and consequences of policy. I think this is somewhat intuitive. For citizens to be able to deliberate about policies, they need to have an epistemic basis for this, which includes reasons for and against policies. In the case of central banks, policies have wide-ranging reasons and consequences. There is a wide literature researching these consequences. While desired outcomes like steering inflation are prominent, they also include secondary effects that are less evident or targeted. To name a few examples, Coibion, Gorodnichenko, Kueng, and Silvia (2017) find links between central bank policy and inequality, while Drudi (2021) and Campiglio, Dafermos, Monnin, Ryan-Collins, Schotten, and Tanaka (2018) research climate-related effects. These two topics are quite salient, because they are not very much addressed, but still affect the general population a lot.

Do central banks communicate this?

So these theories imply that central banks ought to talk about climate change and inequality. To see if they do, I use a topic model to analyze the central bank communications. My data for this is comprised of public communications by the Federal Reserve System. The public is conventionally addressed with press statements and speeches. I obtained all these between 1996 and August 2023 from the Federal Reserve Website, dividing all speeches and statements in their paragraphs. The resulting 91.315 paragraphs are comprised of about 7 million words.

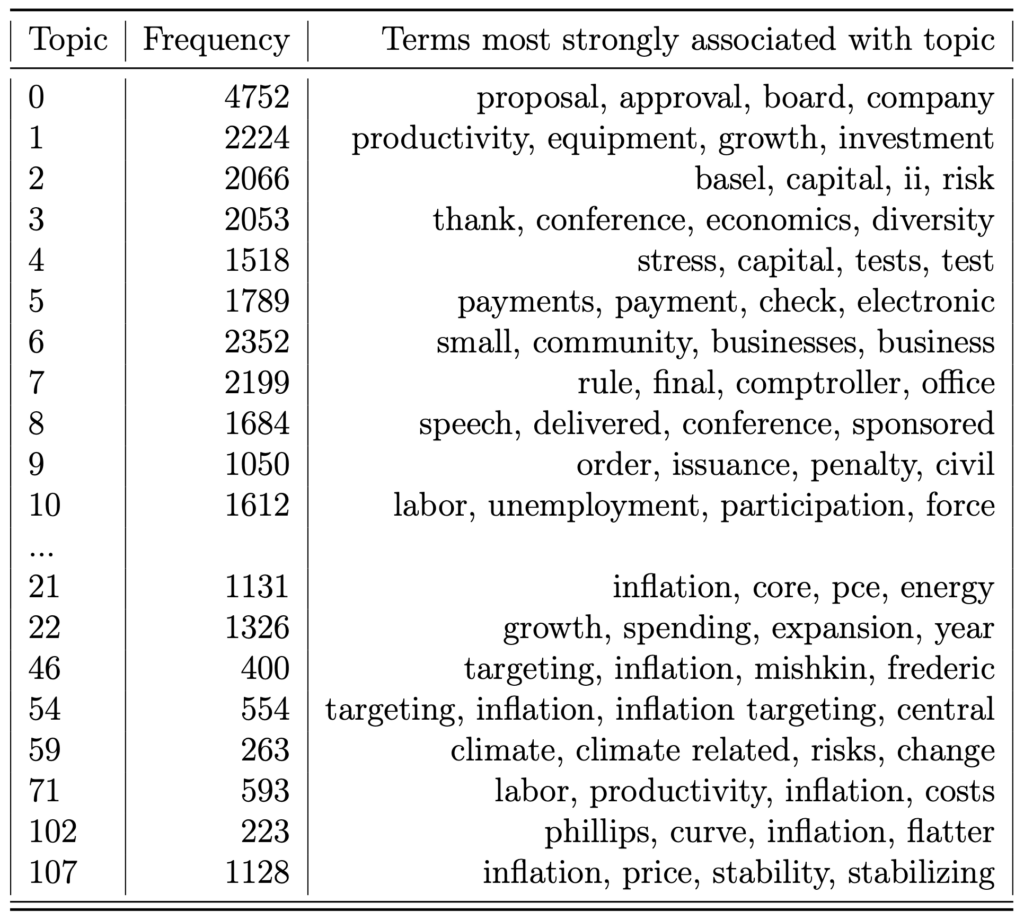

I conduct a topic model analysis of the previously described data sample to evaluate if central banks adhere to the previously outlined framework. For this, BERTopic, by Grootendorst (2022), is used. Abstractly speaking, the method assigns the paragraphs in a high-dimensional space based on their content. Then, it looks for clusters of paragraphs that are close together in space. These are the topic clusters we identify. Based on the distribution of words within the cluster and outside of it, representative words are then chosen that characterize this specific cluster. The clusters with their word labels are then taken as topics.

Table 1 displays the shortened results of the topic model, with the most representative words for the topics. Below the top ten topics, topics relating to inequality and climate are reported, as well as inflation as a comparison. The output shows very little relation to climate or inequality. Inflation is a recurring topic that gets mentioned a lot. In terms of the consequences of policy, unemployment, and growth are addressed most. Specifically, the output does not show any mention of inequality. Topic 59 is the only reference to climate change, making up a total of 0.289% of the total documents. My initial conclusion from this is that the Fed covers the secondary consequences of their policy very limitedly, and thus fails philosophical requirements of their democratic mandate.

Some authors (Hansen, Lin, and Mano (2023)) have recently argued that central banks have changed their coverage of these topics. To analyze this trend over time, I developed a more data-driven way of identifying topics. Briefly stated, I used semantic search to flexibly calculate the similarity of key terms to topics over time. While climate change has experienced an increase of coverage, this can not be said for inequality.

I will close by citing J. Powell, Chair of the Federal Reserve System:

Photo Credits: Paul Morigi

Second, the Fed must continuously earn [its] independence by […] providing transparency to facilitate understanding and effective oversight by the public. –Powell (2023)

In alignment with this perspective, I posit that while the Fed is making strides in enhancing transparency regarding climate change, there remains room for improvement, particularly in addressing economic inequality.

A longer version of this post is available on my Github. Here, I also explain the model and scoring in more detail.

Leave a Reply